Financing Diversity – How Financial Institutions Integrate the Local Community Perspectives’

My key take away from the GLF Biodiversity Digital Conference was that intermediaries and impact-responsive financing is the way forward for biodiversity financing of local communities and smallholders. Compared to other biodiversity finance topics, it provided the most actionable way forward.

Why this topic?

This GLF Biodiversity Digital Conference presentation set itself apart by identify a missing link to the rural financing chain.

From my experience teaching Agricultural Science in Antigua, I learnt that many young people from rural communities go to school to strengthen skills they would have acquired from working in their parents’ small businesses, with the hopes of returning home to improve their families’ livelihoods. Among these youths are the differently-able, who thrive in the hands-on farm work. However, access to financing is based on having collateral and low risk venture, both of which smallholders struggle with. As a result, local communities and smallholders, which are an avenue for local livelihoods including for the disadvantaged, are unable to meet the needs of rural people. So, beyond the issues that make rural communities and livelihoods unattractive for financing, I longed to know what actions can actually be taken to secure financing for rural communities.

Like other biodiversity financing presentations, the discussion laid out compelling arguments as to why local communities and smallholders lack sufficient access to biodiversity funding. This was backed by more than 38 years’ worth of climate investment experience, with a cross section of expertise from grass root advocacy, drivers of environmentally responsible behaviours, fund management, environmental economics and philanthropy, to name a few.

However, knowing what the problems are is not enough. The question remains “if more than a billion people derive livelihoods from forests and trees (Shyamsundar, 2020) and biodiversity underpins global economy (Souza, 2020) why is the burden of biodiversity finance access left to the rural economy – they, who are not empowered to access it?

So, how do financial institutions integrate local community perspectives?

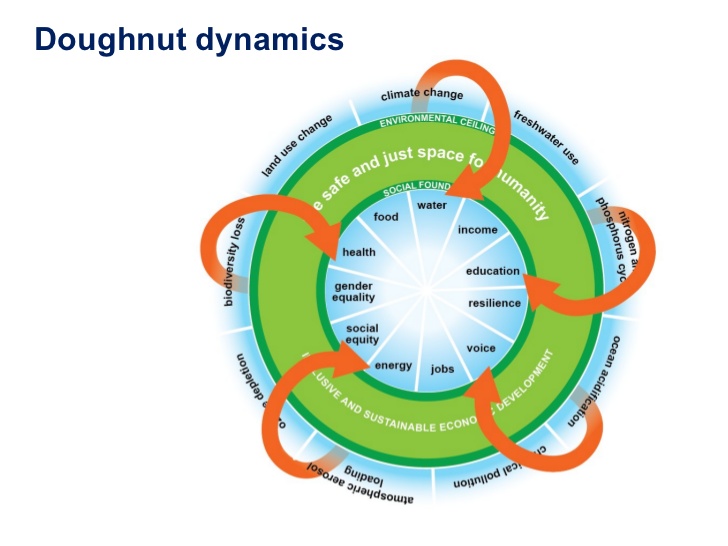

Firstly, there is a collective need to understand that the core of human development has been consumption-centered without much regard for the true value of biodiversity. This has contributed to the undervaluing of raw material producers and livelihoods that depend directly on biodiversity. Additionally, public sector funding is insufficient to meet biodiversity financing needs of local communities and smallholders and so, private sector financing is required.

To integrate local communities and smallholders intermediaries are key. This means that associations and groupings of local communities and smallholder will need to be formed, with formally appointed focal points. These focal points will articulate the needs of local communities and smallholders, to inform the financing streams of financing institutions and to ensure that financing streams are in line with the needs of local communities. The intermediaries would also communicate to stakeholders the requirements of financial institutions in order to be eligible for financing.

At government level private public partnerships need to be established which will serve as the umbrella under which intermediaries engage. The ‘intermediary-financial institution’ relationship can then be operationalized, to address risk reduction measures in the local community and smallholder businesses, with the aim of building a biodiversity financing preparedness foundation in these communities. Some of these measures would address the lack of connectivity as these rural communities and many smallholder farmers are in remote areas, develop the capacity of smallholders and local communities not only in technical skills but financial literacy as well, access to technology, installation of road and other infrastructure to access remote areas, as well as market mechanisms such as carbon credits and more flexible credit systems. Additional risk reduction measures such as certification should be addressed and count towards biodiversity financing preparedness.

The ‘intermediary – financial institution’ relationship will need to establish clearly articulated revenue streams with in-built transparency and accountability checkpoints. It must show what financial streams are available, production targets, associated risks and how these can be mitigated against. Un clear revenue streams are among the barriers to climate financing in the local communities and smallholders, as financial institutions need assurance of returns on investment and legitimacy of said returns. Well-coordinated financial value chains will reduce constraints to financial flows and increase biodiversity financing sustainability.

At government level, local community and smallholder integration will require the formalization of individual and community rights to land as part of the biodiversity finance preparedness. This is important as lack of ownership increases the beneficiaries’ risk profile and hampers smallholder scale up plans.

Another key for integrating local communities and smallholders into financial institutions’ workplans, is impactful biodiversity projects and that fit into the national biodiversity vision. Positive impacts of local community and smallholder projects exist but these are not always articulated. By quantifying and documenting these impacts, rural communities and smallholders will build track records that can assure financial institutions that local communities and smallholders can deliver. As much as possible these impacts should be quantified in monetary terms as this is the method used by financial institutions to gauge return on investment.

Lastly, investors themselves need to be educated and engage in peer to peer education about the value and potential of ecosystem services as well as how to diversify their funding streams to benefit from these services. Ecotourism for example provides an avenue for investors to benefit from ecosystem while promoting sustainability through their concessions on businesses that are in keeping with environmental best practices. Investors can be major environmental transformation catalysts through their support and reward of environmental best practices.

Way forward

Local governments need to push for the establishment of public private partnerships and establish community and smallholder groups or associations with representative intermediaries. Ecosystem based projects should demonstrate and quantify impact in monetary terms.

Reference

Shyamsundar, P. (2020). Re: GLF Biodiversity Digital Conference: One World One Health. Message posted to https://events.globallandscapesforum.org/agenda/biodiversity-2020/28-october-2020/harnessing-the-power-of-nature-financing-diversity/

Souza, A. M. (2020). Re: GLF Biodiversity Digital Conference: One World One Health Message posted to https://events.globallandscapesforum.org/agenda/biodiversity-2020/28-october-2020/harnessing-the-power-of-nature-financing-diversity/